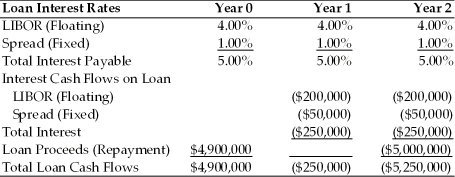

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. What portion of the cost of the loan is at risk of changing?

Definitions:

Profit Maximizing

The mechanism through which a firm calculates the price and output level to maximize its profits.

Workers Paid

Compensation provided to employees in exchange for their labor or services, which can be in the form of wages, salaries, or benefits.

Supply of Labor

The total amount of labor that workers are willing and able to offer at various wage rates in a given time period.

Wage Rate

The amount of compensation a worker receives per unit of time or per unit of output.

Q3: Balance sheet hedge requires an equal amount

Q8: Translation exposure may also be called _

Q13: According to the theory of interest rate

Q14: After being introduced in the 1980s, currency

Q37: The premium or discount on forward currency

Q38: In efficient markets, interest rate parity should

Q39: Operating cash flows may occur in different

Q55: Indirect intervention is<br>A) the alteration of economic

Q82: One of the most important factors in

Q95: What are the two schools of thought