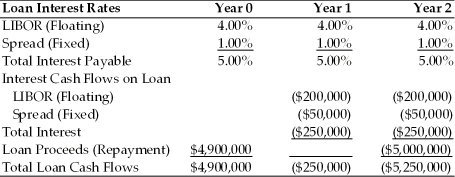

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. If the LIBOR rate jumps to 5.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Discrete Distribution

A statistical distribution that shows the probabilities of outcomes that take on discrete values, such as whole numbers.

Uniform Distribution

A type of probability distribution in which all outcomes are equally likely to occur.

Continuous Random Variable

A random variable that can take an infinite number of values within a given range.

Continuous Probability Distributions

Describes the distribution of possible values for a continuous random variable, where any value within an interval can be a possible outcome.

Q1: Refer to Instruction 9.1. Plains States would

Q10: Which of the following is NOT a

Q19: The global financial marketplace consists of assets,

Q34: The euro was launched in January 1999

Q38: From the viewpoint of a British investor,

Q38: According to the authors, the following types

Q42: Which of the following would be considered

Q51: American college students on the USA-Canadian border

Q57: A currency board is<br>A) a structure, rather

Q77: The choice of when and how to