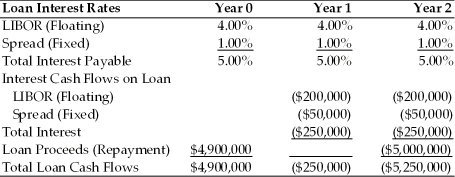

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. What is the all-in-cost (i.e., the internal rate of return) of the Polaris loan including the LIBOR rate, fixed spread and upfront fee?

Definitions:

Appreciation

Appreciation refers to the increase in value of an asset over time, often due to changes in market demand or economic conditions.

Capital Gains

The profit made from selling an asset at a higher price than its purchase price.

Payout Ratio

A financial metric that shows the percentage of a company's earnings paid to shareholders as dividends.

Dividends

Payments made by a corporation to its shareholder members, often derived from the company's profits.

Q3: Refer to Table 7.1. The May call

Q5: The United States taxes the domestic and

Q8: The travel services provided to international travelers

Q9: If the European subsidiary of a U.S.

Q23: A _ resembles a back-to-back loan except

Q31: Under the terms of Bretton Woods countries

Q32: The after-tax cost of debt is found

Q38: Which of the following led to the

Q69: In studies of children reared mainly by

Q73: Whether our genetic predispositions are ever realized