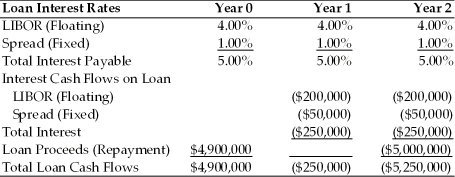

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. What portion of the cost of the loan is at risk of changing?

Definitions:

Long-term Potentiation

A long-lasting enhancement in signal transmission between two neurons that results from stimulating them synchronously, closely related to synaptic plasticity and memory formation.

Hippocampus

A crucial part of the brain responsible for memory formation and spatial navigation.

Neural Communication

The process by which neurons transmit signals to each other through synapses, enabling the functioning of the nervous system.

Associative Learning

A learning process in which a new response becomes associated with a particular stimulus, forming a connection between behavior and consequences or between stimuli in classical and operant conditioning.

Q2: A speculator in the futures market wishing

Q15: Which of the following is NOT an

Q20: Of the following, which was NOT mentioned

Q24: Almost every personality theory we have described

Q25: Translation exposure measures<br>A) changes in the value

Q26: Refer to Table 14.1. What is the

Q28: Comparative advantage shifts over time as less

Q34: In a study of children in Finland,mothers

Q35: What are some of the reasons central

Q49: Which of the following is NOT true