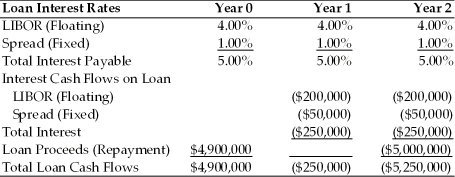

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. If the LIBOR rate jumps to 5.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Negatively Correlated

A relationship between two variables in which one variable increases as the other decreases.

Expected Value

A calculation in statistics that quantifies the average outcome of a random event over a large number of occurrences.

Mean

The average value of a set of numbers, calculated by dividing the sum of all values by the number of values.

Risk Aversion

A preference for safer investments, avoiding risk even at the expense of lower potential returns.

Q7: Each ADR represents _ of the shares

Q14: Level III ADR commitment applies to<br>A) firms

Q20: When a firm enters into a 90

Q21: Refer to Instruction 15.1. What is the

Q29: Almost every nation today (over 90%) has

Q29: US firm submitted a fixed bid for

Q34: The biggest advantage of the current rate

Q36: The WACC is usually used as the

Q45: All exchange rate regimes must deal with

Q52: The Fisher Effect is a familiar economic