Use the information to answer the following question(s) .

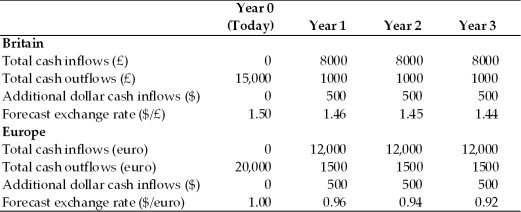

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 17.1. The NPV for the European investment is estimated at

Definitions:

Return on Net Assets

A financial metric that measures how effectively a company is utilizing its net assets to generate profit.

Producer Price Index

An index measuring the average change over time in the selling prices received by domestic producers for their output.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated as the net profit over the cost of investment.

Q1: What is succession planning?

Q2: A _ is establishing a production or

Q12: _ is NOT a popular contractual hedge

Q17: According to the U.S. school of thought,

Q25: According to Scott-Maxwell, old people's outward appearance

Q25: Capital budgeting typically requires some type of

Q40: Lead times and lot sizing help a

Q44: Depositary receipts traded outside the United States

Q46: When a company has an ERP system

Q68: In SAP ERP access to general ledger