Use the information to answer the following question(s) .

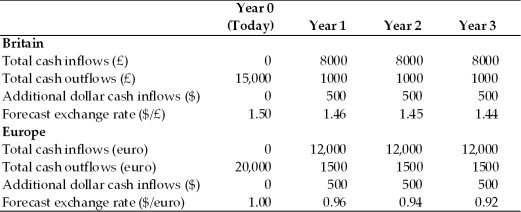

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

-Refer to Table 17.1. If the euro was forecast to remain constant at $1.00/euro throughout the investment period, how would the investment decision now be characterized?

Definitions:

Cash Loan

A type of loan where the borrower receives a cash amount upfront and agrees to pay back both the principal and interest over a set period.

Cash Loan

A financial agreement where a borrower receives a specific amount of cash from a lender and agrees to repay it, with interest, over a set period.

Interest to be Collected

The amount of interest income that has been earned but not yet received in cash.

Cash Loan

A short-term loan provided to a borrower in cash, meant to be repaid with interest over a predetermined period.

Q11: US firm submitted a fixed bid for

Q15: Theoretically, most MNEs should be in a

Q16: Internationally diversified portfolios often have a lower

Q16: Transfer risk concerns mainly the problem of<br>A)

Q34: A collection of activities that takes one

Q39: Because of the international diversification of cash

Q43: Setting prices for customers can be very

Q48: Empirical studies indicate that MNEs have higher

Q50: Generally speaking, currency risk increases as time

Q58: Drafts that have been accepted by banks