Jacobs Company manufactures refrigerators. The company uses a budgeted indirect-cost rate for its manufacturing operations and during 2018 allocated $1,000,000 to work-in-process inventory. Actual overhead incurred was $1,100,000.

Required:

a.Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

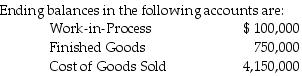

b.Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead accounts.

Definitions:

Government Agency

An entity established by a government to perform a specific function or set of functions, often focusing on public administration, regulation, or the provision of services.

Government in the Sunshine Act

A 1976 U.S. law aimed at ensuring that meetings of government agencies are conducted in public, promoting transparency and accountability.

Transparency

The practice of making actions, decisions, or processes openly accessible and understandable to others, fostering accountability.

Open Forums

Public places or services where people can express and exchange ideas freely, often subject to government protection in terms of free speech rights.

Q12: For a given job the direct costs

Q29: Classic Products Company manufactures colonial style desks.

Q60: The _ is a component of financial

Q76: High Traffic Products Corporation has two departments,

Q114: The following information is for the Jeffries

Q119: Actual costing is a costing system that

Q137: Which account is credited to write off

Q140: Ralph Johnson is paid $30 an hour

Q151: The formula for the predetermined indirect cost

Q204: Contribution margin percentage equals the unit contribution