Moira Company has just finished its first year of operations and must decide which method to use for adjusting cost of goods sold. Because the company used a budgeted indirect-cost rate for its manufacturing operations, the amount that was allocated ($435,000) to cost of goods sold was different from the actual amount incurred ($425,000).

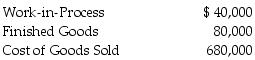

Ending balances in the relevant accounts were:

Required:

a.Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

b.Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead accounts.

Definitions:

Integrity

The quality of being honest and having strong moral principles; moral uprightness.

Sense of Identity

An individual's perception of themselves, their traits, beliefs, and personality.

Basic Trust

A fundamental sense of trust in one's environment and others, considered to be an essential aspect of psychological development in the early years of life.

Conventional Morality

A stage in moral development where individuals make judgments based on societal norms and rules.

Q4: A company's actual performance should be compared

Q30: What is the gross margin for 2018?<br><img

Q69: Which of the following is true about

Q72: The difference between total revenues and total

Q79: When fixed costs are $70,000 and variable

Q101: Product-cost cross-subsidization means that:<br>A) when one product

Q106: An unfavorable variance is conclusive evidence of

Q120: A manufacturer utilizes three separate indirect cost

Q143: Grounds-maintenance costs incurred during the summer months

Q143: Howard Manufacturing Company had the following account