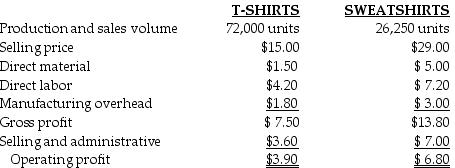

Tiger Pride produces two product lines: T-shirts and Sweatshirts. Product profitability is analyzed as follows:

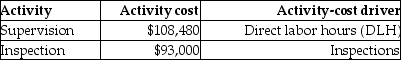

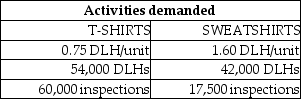

Tiger Pride's managers have decided to revise their current assignment of overhead costs to reflect the following ABC cost information:

Under the revised ABC system, total overhead costs allocated to Sweatshirts will be ________.

Definitions:

Market Value

Market value is the price at which an asset would trade in a competitive auction setting, reflecting what a buyer is willing to pay.

Variable Manufacturing Costs

Variable manufacturing costs are expenses that fluctuate with production volume, such as raw materials and direct labor costs.

Contribution Margin

The amount remaining from sales revenue after variable expenses are deducted, indicating how much contributes to covering fixed costs and generating profit.

Production Capacity

The maximum amount of goods or services that a facility can produce over a given time period under normal operating conditions.

Q12: Columbus Company provides the following ABC costing

Q14: First Class, Inc., expects to sell 22,000

Q24: The Robinson Corporation manufactures automobile parts. During

Q33: Genent Industries, Inc. (GII), developed standard costs

Q40: In the service sector _.<br>A) direct labor

Q98: Direct materials and direct manufacturing labor become

Q121: Milan Company has identified three cost pools

Q132: The actual information pertains to the third

Q156: In the service sector, to achieve timely

Q191: Jacob's Manufacturing sales is equal to production.If