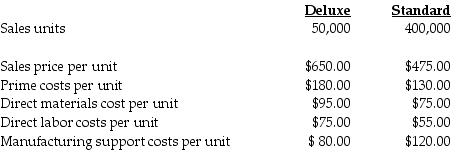

Luzent Company produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs has been direct labor dollars. For 2018, Luzent compiled the following data for the two products:

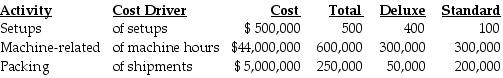

Last year, Luzent Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information for 2018:

Required:

a.Using the current system, what is the estimated

1.total cost of manufacturing one unit for each type of door?

2.profit per unit for each type of door?

b.Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit) than the standard door ($120 per unit). What is a likely explanation for this?

c. "ABC systems may result in misallocation of indirect costs." Do you agree? Give reasons for your answer.

d.What considerations need to be examined when determining a sales mix strategy?

e. While implementing an ABC system for the first time, achieving a significant change overnight is difficult and this may de motivate employees. How can managers overcome this problem?

Definitions:

Newborn Infant

A child at the earliest stage of life, typically considered to be from birth to one month old.

Flavour

The combination of taste and aroma that is experienced when eating or drinking something.

Incentive Models

Theories or systems where rewards are offered to motivate behavior or improve performance.

Buffet

A meal serving style where a variety of dishes are displayed, and diners serve themselves according to their preference.

Q7: Which of the following could be a

Q8: Blistre Company operates on a contribution margin

Q11: Indirect manufacturing costs are credited to Manufacturing

Q13: Tony Manufacturing produces a single product that

Q20: Rachel's Pet Supply Corporation manufactures two models

Q62: With traditional costing systems, products manufactured in

Q94: When $10,0000 direct materials are requisitioned, which

Q113: Which of the following statements is true

Q164: Which of the following includes both traced

Q167: Give at least three good reasons why