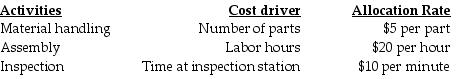

Nichols Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager is considering switching-over to ABC costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour.

What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 10 remote controls are produced? The batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Definitions:

AFC Curve

The average fixed cost curve, representing the fixed costs associated with producing goods or services, spread out over the quantity produced.

Fixed Cost

Costs that do not vary with the level of output or business activity, such as rent, salaries, and insurance premiums.

Average Fixed Cost

The fixed costs of production divided by the quantity of output produced, representing how fixed costs dilute as more units are produced.

Variable Costs

Costs that vary directly with the level of production or business activity, such as materials and labor used in the production of goods.

Q35: Problems with costing occur when _.<br>A) incorrect

Q40: Ruben is a travel agent. He intends

Q52: Ballpark Concessions currently sells hot dogs. During

Q56: Service-sustaining costs are the costs of activities

Q66: Handley Manufacturing Company has prepared the following

Q66: Hammond and Jarrett provide tax consulting for

Q82: James Ford an architect charges $150 per

Q128: Whether a company chooses to use either

Q128: Which of the following is most likely

Q131: Tally Corp. sells software during the recruiting