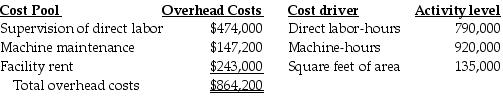

Nile Corp. has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

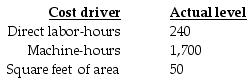

The accounting records show the Mossman Job consumed the following resources:

If Nile Corp. uses the three activity cost pools to allocate overhead costs, what are the activity-cost driver rates for supervision of direct labor, machine maintenance, and facility rent, respectively?

Definitions:

Indirect Labor

Labor costs associated with workers who are not directly involved in the production of goods or services, such as maintenance staff and supervisors.

Factory Overhead

The costs associated with manufacturing operations that are not directly traceable to a product, including costs related to the maintenance and operation of the factory.

Operating Expenses

Costs related to the day-to-day functioning of a business, excluding the cost of production.

Product Costs

The costs directly associated with the production of goods, including raw materials, labor, and manufacturing overhead.

Q2: Frazer Corp sells several products. Information of

Q4: Activity-based costing information can be used for

Q4: The breakeven point revenues is calculated by

Q35: Jalbert Incorporated planned to use materials of

Q85: The degree of operating leverage at a

Q102: Service companies and not-for-profit organizations _.<br>A) cannot

Q116: Luzent Company produces two types of entry

Q123: Uniformly assigning the costs of resources to

Q158: A flexible budget _.<br>A) is another name

Q172: The difference between total revenues and total