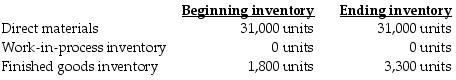

First Class, Inc., expects to sell 26,000 pool cues for $14 each. Direct materials costs are $2, direct manufacturing labor is $4, and manufacturing overhead is $0.89 per pool cue. The following inventory levels apply to 2019:

On the 2019 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Licensing

The act of granting permission to use intellectual property rights, such as patents or trademarks, under agreed terms and conditions.

Foreign Distribution Agreements

Contracts between companies for the distribution of goods or services in countries other than their own.

Merchandise

Goods that are bought and sold in commerce; typically refers to the items stocked and offered for sale by a retail or wholesale business.

Arbitration Clause

A provision in a contract requiring that disputes between the parties be resolved through arbitration rather than through the court system.

Q14: Coffey Company maintains a very large direct

Q18: Daniels Corporation used the following data to

Q21: The accounting for 3-variance analysis is simpler

Q41: In a flexible budget _.<br>A) variable costs

Q46: For next year, Roberts, Inc., has budgeted

Q49: What is sales mix? How do companies

Q62: It is best to rely totally on

Q72: Outdoor Gear Corporation manufactured 5,000 coolers during

Q76: A cost is considered direct if it

Q165: Overcosting a particular product may result in:<br>A)