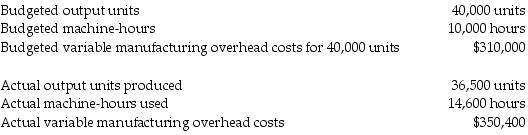

Really Great Corporation manufactures industrial-sized landscaping trailers and uses budgeted machine-hours to allocate variable manufacturing overhead. The following information pertains to the company's manufacturing overhead data:

What is the budgeted variable overhead cost rate per output unit?

Definitions:

New Group

A category or collection of items or entities that are formed or compiled together for a specific purpose or identification.

IRS

The United States Internal Revenue Service, a federal agency responsible for collecting taxes and administering the Internal Revenue Code.

Accrual Basis

An accounting method where revenues and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid.

Cash Basis

An accounting method where revenues and expenses are recognized when cash is actually received or paid out.

Q4: A company's actual performance should be compared

Q14: First Class, Inc., expects to sell 22,000

Q87: Which of the following best describes a

Q100: Raul Technologies is concerned that increased sales

Q112: Stark Corporation has two departments, Car Rental

Q124: A regional manager of a restaurant chain

Q144: For revenue items, a favorable variance means

Q160: Define variable overhead spending variance. Briefly explain

Q164: Budgeting is a mechanical tool because the

Q196: Which of the following approaches spreads underallocated