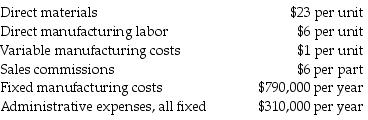

Fast Track Auto produces and sells an auto part for $85 per unit. In 2017, 110,000 parts were produced and 90,000 units were sold. Other information for the year includes:

What is the inventoriable cost per unit using absorption costing?

Definitions:

Traditional IRA

A savings plan in which the income generated by the account is tax-deferred until it is withdrawn from that account.

Tax Liability

The total amount of tax that an individual or organization owes to the tax authorities.

401k Contributions

401k contributions are pre-tax or post-tax money individuals contribute to their 401k retirement savings plan, often matched by their employer to some extent.

Biweekly Paycheck

A payment method where employees receive wages every two weeks, resulting in 26 paychecks per year.

Q36: Hockey Accessories Corporation manufactured 21,400 duffle bags

Q48: If 800 units are produced and 1,200

Q69: Taunton Company uses the high-low method to

Q84: Explain the three alternative approaches to dispose

Q90: Under variable costing, lease charges paid on

Q111: The high-low method _.<br>A) measures the difference

Q122: Which variance is calculated using the formula

Q135: A favorable production-volume variance arises when manufacturing

Q142: Lubriderm Corporation has the following budgeted unit

Q157: Evaluating performance of managers over a long