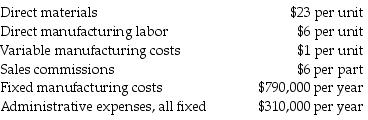

Fast Track Auto produces and sells an auto part for $85 per unit. In 2017, 110,000 parts were produced and 90,000 units were sold. Other information for the year includes:

What is the inventoriable cost per unit using absorption costing?

Definitions:

Q22: List the four steps to develop budgeted

Q42: Under absorption costing, if a manager's bonus

Q53: If machine maintenance is scheduled at a

Q86: U.S. tax reporting requires end-of-period reconciliation between

Q93: If a cost item is fixed for

Q93: A favorable price variance for direct manufacturing

Q94: Misinterpretation of data can arise when fixed

Q153: Estate Corp., has the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3027/.jpg"

Q155: Kaizen refers to incorporating cost reductions _.<br>A)

Q199: Using practical capacity is best for evaluating