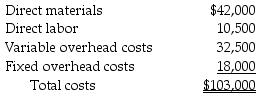

W.T. Ginsburg Engine Company manufactures part ACT31107 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 6% of the fixed overhead costs assigned to ACT31107 will no longer be incurred if the company purchases ACT31107 from the outside supplier. W.T. Ginsburg Engine Company has the option of purchasing the part from an outside supplier at $94.75 per unit.

If W.T. Ginsburg Engine Company purchases 1,000 ACT31107 parts from the outside supplier per month, then its monthly operating income will ________. (Round any intermediary calculations and your final answer to the nearest cent.)

Definitions:

Ledger Accounts

Detailed financial records maintained within the ledger, tracking transactions related to specific assets, liabilities, equity, income, and expenses.

Dividends Account

An account that records the dividends declared by a corporation to be distributed to its shareholders.

Net Income

The total profit of a company after all expenses, including taxes, have been deducted from revenues.

Closing Entries

These are journal entries made at the end of an accounting period to transfer temporary accounts to permanent accounts, hence preparing the books for the next period.

Q24: Jack Williams has just purchased the film

Q32: The time taken to fulfill clients' requests

Q60: Jake's Copy Center hires a new employee.

Q63: The incremental unit-time learning model with a

Q64: Bennet Company employs 20 individuals. Eighteen employees

Q80: Bosely Corporation is reviewing its business strategy.

Q94: Misinterpretation of data can arise when fixed

Q101: When comparing the operating incomes between absorption

Q175: Jack's Back Porch manufactures rustic furniture. The

Q210: A cost may be relevant for one