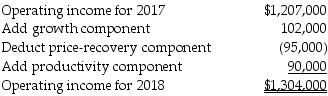

An operating income analysis of Fast Processing Company revealed the following:

Fast's operating income gain is consistent with the ________.

Definitions:

Medicare Tax Rate

The percentage of an individual's earnings that is deducted to fund the Medicare program, as specified by federal law.

Social Security Tax

A tax that funds the Social Security program, collected from both employers and employees to provide retirement, disability, and survivor benefits.

Hourly Wage Rate

The sum of money received for every hour worked.

Gross Pay

The total amount of money an employee earns before any deductions or taxes are applied.

Q9: When there is a constraining resource, a

Q20: There are alternative ways of measuring the

Q25: Which of the following involves a fundamental

Q39: Which of following is a firm's risk

Q71: The theory of constraints (TOC) defines throughput

Q87: A composite unit is a hypothetical unit

Q117: Illumination Corp operates one central plant that

Q133: Dartmouth Building Products Inc. provides the following

Q162: Using the fairness criterion, the costs are

Q164: Why is choosing the correct cost driver