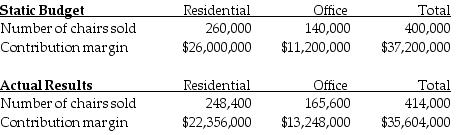

The Chair Company manufactures two modular types of chairs: one for the residential market, and the other for the office market. Budgeted and actual operating data for the year 2015 are:

Required:

Compute the following variances in terms of contribution margin:

a.Compute the total static-budget variance, the total flexible-budget variance, and the total sales-volume variance.

b.Compute the sale-mix variance and the sales-quantity variance by type of chair, and in total.

Definitions:

Withheld FICA Tax

Taxes taken out of an employee's paycheck for Social Security and Medicare.

Excess Social Security Tax

The amount of Social Security taxes paid over the maximum limit set for the year, which can occur when an individual works for multiple employers.

Form 1040

The conventional form from the Internal Revenue Service (IRS) employed by individuals to declare their annual income taxes.

Withholding Allowances

A number that employees claim on a W-4 form that determines the amount of money withheld from their paycheck for taxes.

Q11: Discretionary costs are not easily controllable compared

Q16: Which of the following statements is a

Q34: Strategic Analysis of Profitability of King Philip

Q60: There is a direct cause-and effect relationship

Q91: For each of the following methods of

Q99: Golden Generator Supply is approached by Mr.

Q132: What is the name of a cost

Q142: The Brital Company processes unprocessed milk to

Q197: A graph comparing locked-in costs with incurred

Q206: Jamal, Kareem, Rashid and Associates are in