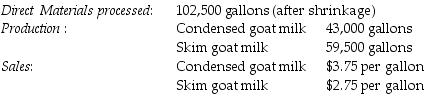

The Green Company processes unprocessed goat milk up to the split-off point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 102,500 gallons of saleable product was $186,480. There were no inventory balances of either product. Condensed goat milk may be processed further to yield 42,500 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $21 per gallon.

Skim goat milk can be processed further to yield 58,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $3. The product can be sold for $8 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at split-off method, what is the gross-margin percentage for condensed goat milk at the split-off point? (Round intermediary percentages to the nearest hundredth.)

Definitions:

Indohyus

An extinct genus of even-toed ungulate that lived about 48 to 41 million years ago, believed to be an early relative of whales.

Pakicetus

An extinct genus of early whales living in the Eocene epoch, illustrating a significant stage in the transition from land to sea creatures.

Modern-day Whales

Current species of whales that descended from land-dwelling ancestors through a series of evolutionary transitions over millions of years.

Hippopotamus

A large, mostly herbivorous mammal native to sub-Saharan Africa, known for its large size, semi-aquatic habits, and aggressive nature.

Q8: Netzone Company is in semiconductor industry and

Q9: Which of the following is true of

Q16: The constant gross-margin percentage NRV method is

Q29: An alternative way to implement the reciprocal

Q64: Developing a product that satisfies the need

Q64: High Universal Industries operates a division in

Q97: Hanung Corp has two service departments, Maintenance

Q122: Revenue allocation is required to determine the

Q129: Costs in beginning inventory are pooled with

Q150: Alfred, owner of Hi-Tech Fiberglass Fabricators, Inc.,