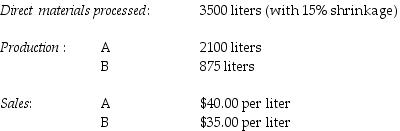

Cola Drink Company processes direct materials up to the split-off point where two products, A and B, are obtained. The following information was collected for the month of July:

The cost of purchasing 3500 liters of direct materials and processing it up to the split-off point to yield a total of 2975 liters of good products was $7000. There were no inventory balances of A and B.

Product A may be processed further to yield 2000 liters of Product Z5 for an additional processing cost of $160. Product Z5 is sold for $60.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 800 liters of Product W3 for an additional processing cost of $290. Product W3 is sold for $65 per liter. There was no beginning inventory and ending inventory was 25 liters.

What is Product Z5's estimated net realizable value at the split-off point?

Definitions:

Marginal Propensity To Save

The fraction of an increase in income that is saved rather than spent on consumption.

Recessionary Periods

Times characterized by a significant decline in economic activity across the economy, lasting more than a few months, typically visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Tax Revenues

The income that is gained by governments through taxation, which is used to fund public services and government obligations.

National Income

The total amount of money earned within a country from the production of goods and services over a specific period of time.

Q82: Which of the following statements is true

Q82: Underestimating the degree of completion of ending

Q86: Managers can gain more insight about the

Q98: Which of the following statements is true?<br>A)

Q104: In joint costing, the constant gross-margin percentage

Q106: Woodruff Flowering Plants provides the following information

Q109: At what point are direct material costs

Q119: Which of the following is an assumption

Q127: What is the difference between a weighted-average

Q140: Explain the difference between locked in costs