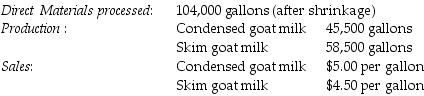

The Green Company processes unprocessed goat milk up to the split-off point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 104,000 gallons of saleable product was $186,480. There were no inventory balances of either product. Condensed goat milk may be processed further to yield 45,000 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $4 per usable gallon. Xyla can be sold for $19 per gallon.

Skim goat milk can be processed further to yield 57,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $4. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using estimated net realizable value, what amount of the joint costs would be allocated Xyla and the skim goat ice cream? (Round intermediary percentage calculations to the nearest hundredth.)

Definitions:

Consumer Surplus

The gap between the total price consumers are prepared and able to pay for a service or product and the amount they really pay.

World Price

The international market price of a product or commodity, influenced by global supply and demand conditions.

Free Trade

An economic policy that allows imports and exports between countries with minimal or no barriers to trade, such as tariffs or quotas, encouraging international commerce.

Imported

Brought into a country from abroad for the purpose of selling.

Q32: Fish Fillet Incorporated obtains fish and then

Q55: The Fortise Corporation manufactures two types of

Q57: The Octova Corporation manufactures two types of

Q65: In companies that produce masses of identical

Q67: Rework is an example of _.<br>A) prevention

Q73: Revenue allocation is used when _.<br>A) revenues

Q83: Audrey Auto Accessories manufactures plastic moldings for

Q104: Expo Manufacturing Inc., is in the process

Q125: Jane Industries manufactures plastic toys. During October,

Q129: Wilde Corporation budgeted the following costs for