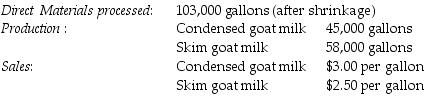

The Green Company processes unprocessed goat milk up to the split-off point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 103,000 gallons of saleable product was $186,480. There were no inventory balances of either product. Condensed goat milk may be processed further to yield 44,500 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $7 per usable gallon. Xyla can be sold for $25 per gallon.

Skim goat milk can be processed further to yield 56,700 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $7. The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

How much (if any) extra income would Green earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the split-off point. (Round intermediary percentages to the nearest hundredth.)

Definitions:

Return on Investment

A financial ratio used to calculate the profitability of an investment, representing the percentage return on the invested amount.

Markup

The difference between the cost of a product or service and its selling price, expressed as a percentage over the cost.

Absorption Costing

A calculation technique in which the cost of a product is determined by including all costs associated with manufacturing, including direct materials, direct labor, as well as variable and fixed overhead costs.

Cost-plus Pricing

A pricing strategy where a fixed percentage is added to the total cost of producing a product to determine its selling price.

Q12: Knowledge Transfer Associates is in the process

Q14: A customer cost hierarchy categorizes costs related

Q18: Timekeeper Inc. manufactures clocks on a highly

Q28: Spoilage that is an inherent result of

Q90: Foodiez Inn is a fast-food restaurant that

Q95: The sales-mix variance is the difference between

Q125: The dual cost-allocation method classifies costs into

Q126: Dessa Cabinetry, Inc., manufactures standard sized modular

Q130: When evaluating alternatives to improve quality, both

Q167: Companies that want to calculate the full