Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

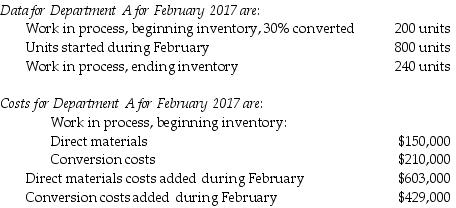

How many units were completed and transferred out of Department A during February?

Definitions:

Fixed Expenses

Costs that do not vary with the level of production or sales, remaining constant over a period of time.

Variable Expenses

Charges that adjust directly with the volume of production or sales, encompassing costs related to raw materials and direct labor.

Fixed Expenses

Costs that do not change with the level of production or sales within a certain range and for a specific period.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Q25: Allocating variable costs on the basis of

Q41: The following information applies to Krynton Corp.

Q50: In joint costing, which method assumes that

Q61: Warranty repair cost is an example of

Q62: FIFO Aluminum processes a single type of

Q74: The Brital Company processes unprocessed milk to

Q80: The stand-alone cost allocation method ranks the

Q112: Describe the differences between process costing and

Q113: How is value-engineering relevant to a well

Q123: More insight into the static-budget variance can