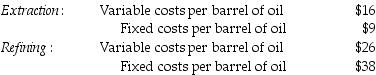

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel.

Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel. The Refining Division sells the 260 barrels at a price of $220 each to customers. What is the operating income of both divisions together?

Definitions:

Zero-Coupon Bonds

Bonds that are issued at a discount to their face value and do not pay periodic interest, but rather pay the face value at maturity.

Yield

The income return on an investment, such as the interest or dividends received, typically expressed as an annual percentage rate based on the investment's cost, its current market value, or its face value.

Face Value

The nominal or dollar value stated on a security or financial instrument, such as a bond or stock.

Real Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing.

Q17: Cause-and-effect diagrams are used in quality management

Q42: Craylon Corp has three divisions, which operate

Q53: The Fabrication Division of American Car Company

Q60: Discuss the means by which a company

Q95: Which of the following statements best defines

Q103: The required rate of return multiplied by

Q112: Manufacturing cycle times affect both revenues and

Q113: The only product of a company has

Q129: The Controller of Nip-it-in-the-Bud Inc. has studied

Q148: Hybrid transfer prices take into account both