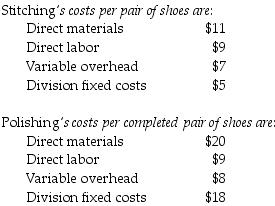

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $48. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units.

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

Definitions:

Conversion Cost

The sum of direct labor and manufacturing overhead costs, representing the expense to convert raw materials into finished products.

Average Cost Method

An inventory costing method that calculates the cost of goods sold based on the average cost of all similar items in inventory.

Equivalent Unit

A measure used in cost accounting to express the amount of work done by manufacturers on units that are partially completed at the end of an accounting period.

Applied Overhead

The portion of overhead costs allocated to specific jobs or departments based on a predetermined rate.

Q14: Which of the following is a responsibility

Q15: All other things held constant, increase in

Q19: Inflation clouds the real economic returns on

Q21: The salary component of compensation dominates when

Q31: The top management at Groundsource Company, a

Q47: An important consideration in designing compensation arrangements

Q63: Bock Construction Company is considering four proposals

Q125: A company has operating income of $300,000,

Q138: The product or service transferred between subunits

Q145: The following information applies to Krynton Corp.