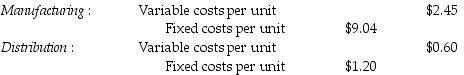

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,010,000 units a week and usually purchases 2,005,000 units from the Manufacturing Division and 2,005,000 units from other suppliers at $15.00 per unit.

What is the transfer price per watch from the Manufacturing Division to the Distribution Division, assuming the method used to place a value on each transfer is 125% of full costs?

Definitions:

Negative Income Tax

A fiscal mechanism designed to provide income to individuals or families whose earnings fall below a certain level, effectively supplementing their income through a government subsidy.

Taxes Owed

The amount of money that an individual, corporation, or other entity is legally obligated to pay to governmental authorities, typically calculated based on income, property value, or consumption.

Income Subsidy

A monetary assistance provided by the government to individuals or groups to increase their income level, often aimed at reducing poverty.

Redistributing Income

The transfer of income from certain individuals or groups to others through mechanisms like taxation, welfare programs, and social policies to achieve greater social equity.

Q12: The capital budgeting method that calculates the

Q24: Relative performance evaluation _.<br>A) determines the effective

Q52: The full cost plus a markup transfer-pricing

Q70: The top management at Groundsource Company, a

Q72: Tornado Electronics manufactures stereos. All processing is

Q76: Bedtime Bedding Company manufactures pillows. The Cover

Q84: Transfer prices do not affect managers whose

Q86: If internal rate of return is less

Q99: Assume your goal in life is to

Q144: An excessive focus on diagnostic control systems