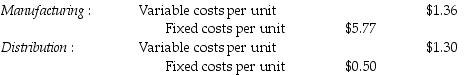

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,009,000 units a week and usually purchases 2,004,500 units from the Manufacturing Division and 2,004,500 units from other suppliers at $13.00 per unit.

Assume 110,000 units are transferred from the Manufacturing Division to the Distribution Division for a transfer price of $8.00 per unit. The Distribution Division sells the 110,000 units at a price of $18 each to customers. What is the operating income of both divisions together?

Definitions:

Nonneutral Tax

A tax that impacts differently on different types of economic activities, influencing the allocation of resources.

Perfectly Elastic

Describes a market situation where product demand or supply can vary greatly with a small change in price.

Excess Burden

The economic cost to society exceeding the revenue generated by a tax, often resulting from distortions in market behavior.

Economic Decisions

The choices made by individuals, businesses, governments, and other groups that affect the allocation of resources and the distribution of goods and services.

Q11: Malive Park Department is considering a new

Q15: If the distress price is used as

Q30: Under backflush costing approach where three trigger

Q32: Games R Us manufactures various games. For

Q34: Which of the following is not true

Q45: Historical costs are costs recognized in particular

Q62: Discuss a range of factors that managers

Q82: Executive compensation plans are based on both

Q131: The discount rate used to calculate the

Q146: Craylon Corp. is planning the 2018 operating