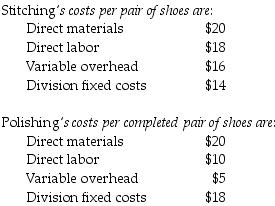

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $52. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units. The fixed costs for the Polishing Division are assumed to be $24 per pair at 103,000 units.

What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the method used to place a value on each pair of shoes is 175% of variable costs?

Definitions:

Special Cost Pool

A financial management term for aggregating specific costs together, typically for reporting or reimbursement purposes.

ABC System

An approach in accounting that allocates overhead and indirect costs to specific activities related to the production of a product or service.

Allocating Costs

The process of assigning indirect expenses to different departments, products, or projects based on relevant criteria.

Measure Of Activity

A parameter or unit used to quantify the level of operational or production activity within a specific period.

Q14: Capital budgeting is both a decision making

Q27: Upon which of the following items does

Q36: Cost-based transfer prices are often used when

Q37: Managers identify the relevant costs and benefits

Q63: Bock Construction Company is considering four proposals

Q68: Tran-North American Industries Inc. is looking at

Q76: A commitment to a new capital project

Q122: Super Shoes Company manufactures sneakers. The Athletic

Q125: The accounting procedures in a backflush-costing system

Q127: Managers prefer projects with higher IRRs to