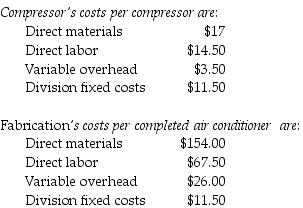

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $60.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 13,000-18,000 units. The fixed costs for the Fabrication Division are assumed to be $11.00 per unit at 18,000 units.

If the Fabrication Division sells 1000 air conditioners at a price of $475.00 per washing machine to customers, what is the operating income of both divisions together?

Definitions:

FIFO

"First In, First Out," an inventory valuation method where the oldest inventory items are recorded as sold first.

Perpetual Inventory System

A method of accounting for inventory that records sales and purchases of inventory instantly through the use of computerized point-of-sale systems and enterprise asset management software.

FIFO

An inventory valuation method that assumes the first items placed in inventory are the first sold (First In, First Out).

Q13: An annuity is _.<br>A) a noncash expense<br>B)

Q15: Cedile Trailer Supply has received three proposals

Q16: The River Falls Company has two divisions.

Q31: An inventory item of Avizone Corp. has

Q35: Dual pricing insulates managers from the realities

Q45: Which of the following is an internal-business-process

Q54: How does cost-based transfer price method help

Q91: _ occurs when a decision's benefits for

Q111: Proponents of lean accounting argue that the

Q150: A costing system that omits recording some