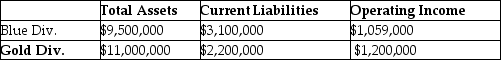

Springfield Corporation, whose tax rate is 30%, has two sources of funds: long-term debt with a market value of $8,400,000 and an interest rate of 8%, and equity capital with a market value of $14,000,000 and a cost of equity of 13%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places.)

Definitions:

Erectile Disorder

A medical condition characterized by the consistent inability to maintain an erection sufficient for satisfactory sexual performance.

Affectual Awareness

The capacity to recognize, understand, and process one's own emotions or feelings.

Self-Instruction Training

A treatment developed by Donald Meichenbaum that teaches people to use coping self-statements at times of stress, discomfort, or significant pain. Also called stress inoculation training.

Systematic Desensitization

A behavioral therapy technique used to reduce phobic reactions and anxiety through gradual exposure to the feared object or situation while practicing relaxation techniques.

Q1: One advantage of prorating the difference between

Q14: Which of the following is a responsibility

Q17: In nominal rate of return, the inflation

Q30: Under backflush costing approach where three trigger

Q36: Cost-based transfer prices are often used when

Q44: The top management at Amore Corp, a

Q54: Hypore Darby Park Department is considering a

Q55: Goal congruence exists when individuals work toward

Q61: When using transfer prices based on costs

Q92: Which of the following statements is true