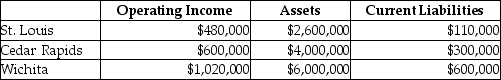

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 35%.

What is the EVA® for St. Louis? (Round intermediary calculations to four decimal places.)

Definitions:

Atmosphere

The layers of gas surrounding a planet, held in place by gravity, and composed of various gases that protect and sustain life on Earth by absorbing ultraviolet solar radiation, warming the surface through heat retention, and reducing temperature extremes between day and night.

Photosynthesis

The process by which green plants and some other organisms use sunlight to synthesize foods from carbon dioxide and water. Photosynthesis in plants generally involves the green pigment chlorophyll and generates oxygen as a byproduct.

Cellular Respiration

Metabolic reactions that use the energy from carbohydrate, fatty acid, or amino acid breakdown to produce ATP molecules.

Decomposers

Organisms that break down dead or decaying organisms, contributing to the nutrient cycle by recycling nutrients back into the ecosystem.

Q2: Retail Outlet is looking for a new

Q10: As a discounted cash flow method does

Q15: Cedile Trailer Supply has received three proposals

Q35: Dual pricing insulates managers from the realities

Q58: In comparing the three basic approaches to

Q65: The net present value method accurately assumes

Q70: The income taxes saved as a result

Q99: Assume your goal in life is to

Q110: Provide the missing data for the following

Q128: Which of the following best describes interactive