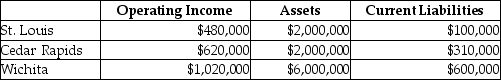

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places.)

Definitions:

Corporate Tax Rate

The percentage of a corporation's profits that is paid to the government as tax, varying by country and sometimes by the size or type of business.

Enterprise Multiple

A ratio used to determine the value of a company that takes into account its debt and equity, calculated by dividing the enterprise value by EBITDA.

EBIT

Known as Earnings Before Interest and Taxes, this financial gauge calculates a firm's profitability without considering interest and income tax charges.

Average Collection Period

The average number of days it takes for a company to collect payments from its customers, a measure of the efficiency of its credit policies.

Q4: Axelia Corporation has two divisions, Refining and

Q29: Return on investment, Residual income, or Economic

Q46: The Jarvis Corporation produces bucket loader assemblies

Q52: A company which favors the residual income

Q58: The DuPont method recognizes the two basic

Q65: The net present value method accurately assumes

Q97: Clothes, Inc., has an average annual demand

Q107: Higher inflation will lead to higher prices

Q129: If a computer manufacturer used its common

Q134: A weaknesses of the payback method is