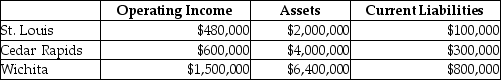

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,400,000 issued at an interest rate of 12%, and equity capital that has a market value of $4,300,000 (book value of $2,100,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 35%.

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places.)

Definitions:

Temperament Classification

A method of categorizing individuals based on their typical responses to the environment, including aspects such as mood, activity level, and emotional reactivity.

Easy

denotes something that can be achieved or understood with minimal effort or difficulty.

Difficult

Involving hard work, effort, or complexity that makes a task or situation challenging to execute or resolve.

Slow to Warm Up

Describes individuals, particularly children, who display a cautious approach to new experiences or people, taking longer to adapt or become comfortable.

Q14: Capital budgeting is both a decision making

Q49: If the net present value for a

Q64: Transferring products internally at a market price

Q71: When cost-based transfer pricing is used between

Q82: Executive compensation plans are based on both

Q97: Which of the following is true about

Q108: Due to unprecedented growth during the year,

Q128: In lean accounting environments, it is critical

Q137: The following information applies to Krynton Corp.

Q149: Springfield Corporation, whose tax rate is 30%,