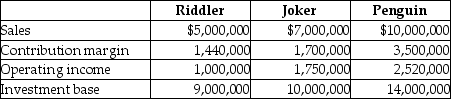

Batman Abstract Company has three divisions that operate autonomously. Their results for 2015 are as follows:

The company's desired rate of return is 20%.

Required:

a.Compute each division's ROI.

b.Compute each division's residual income.

c.Rank each division by both ROI and residual income.

d.Which division had the best performance in 2015? Why?

Definitions:

M2

A classification of money supply that includes cash, checking deposits, and easily convertible near money like savings deposits, money market securities, and mutual funds.

Money Supply

The total financial assets existing in an economy at a specific period, incorporating cash, coins, and the balances maintained in checking and savings accounts.

Banking System

The structure of banks and financial institutions within an economy, which provides financial services including deposits, loans, and currency exchange.

M2

A measure of the money supply that includes cash, checking deposits, and easily convertible near money.

Q12: The objective of maximizing return on investment

Q17: Division A sells ground veal internally to

Q28: Plish Company manufactures only one type of

Q32: Surveys indicate that decisions made most frequently

Q41: A "what-if" technique that examines how a

Q48: Antique Corp uses the investment center concept

Q49: The demand-pull feature of JIT production systems

Q97: Clothes, Inc., has an average annual demand

Q113: The only product of a company has

Q128: In the "obtain information" stage of capital