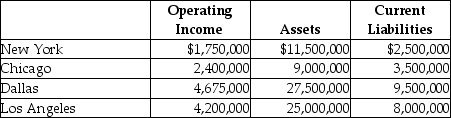

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million (book value of $8 million). The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centers in four divisions that operate autonomously. The company's results for 2015 are as follows:

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

Definitions:

Profit

The financial gain achieved when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity.

Contribution Margin

The difference between sales revenue and variable costs, serving as a measure to assess the profitability of products or services.

Fixed Expenses

Costs that do not change with the level of production or sales, such as rent, insurance, and salaries.

Net Operating Income

Income derived from the main activities of a business, not including interest and tax deductions.

Q2: Retail Outlet is looking for a new

Q18: Which of the following is the first

Q40: Which of the following denotes minimum transfer

Q47: The management accounting system is an informal

Q76: For supply item ABC, Andrews Company has

Q89: Capital budgeting is the process of making

Q90: Net initial investment includes _.<br>A) depreciation on

Q101: The transfer price creates revenues for the

Q106: In calculating the net initial investment cash

Q110: The internal rate of return method assumes