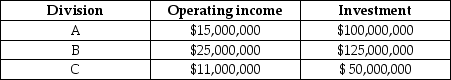

Capital Investments has three divisions. Each division's required rate of return is 15%. Planned operating results for 2015 are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a.Compute the current ROI for each division.

b.Compute the current residual income for each division.

c.Rank the divisions according to their current ROIs and residual incomes.

d.Determine the effects after adding the new project to each division's ROI and residual income.

e.Assuming the managers are evaluated on either ROI or residual income, which divisions are pleased with the expansion and which ones are unhappy?

Definitions:

Ratio Analysis

A quantitative method used in financial analysis to assess the financial health, performance, and condition of a company by examining its financial statements.

Ethics Audit

A systematic evaluation of an organization's ethics programs and practices, intended to identify potential risks and areas for improvement in ethical conduct.

Ethics Auditing

The systematic examination and evaluation of an organization's ethical policies, practices, and performance to ensure accountability and alignment with ethical standards.

Financial Auditing

The process of examining an organization's financial statements to ensure they are accurate and conform to laws and regulations.

Q7: Traditional normal and standard costing systems usually

Q35: What are the strengths and weaknesses of

Q36: Cost-based transfer prices are often used when

Q42: Craylon Corp has three divisions, which operate

Q43: Briefly explain each of the four levels

Q57: Carriage Incorporated manufactures horse carriages. The company

Q84: How is inflation related to capital budgeting?

Q126: Tax deductions for depreciation result in tax

Q127: Managers prefer projects with higher IRRs to

Q132: Which of the following is a stage