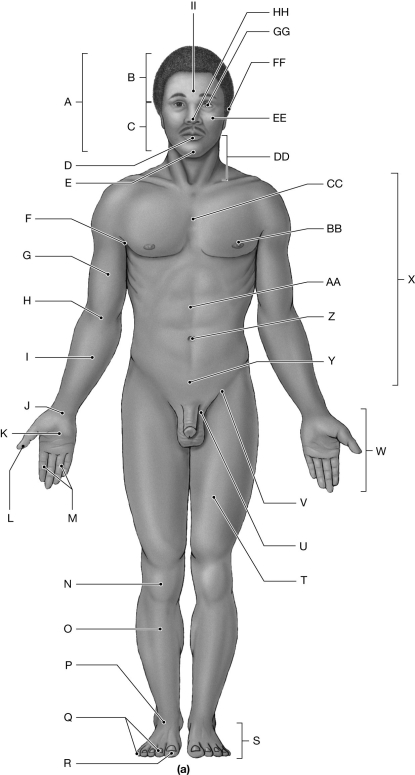

Figure 1.2

Using the figure above, identify the labeled part.

-Label J: ______________________________

Definitions:

Professional Dues

Fees paid to a professional organization or union that the member may be able to deduct on their tax return.

Medical Expense Deduction

A tax deduction for expenses related to the diagnosis, cure, mitigation, treatment, or prevention of disease.

Adjusted Gross Income

Gross income minus adjustments, used to determine taxable income on an individual's tax return.

Health Insurance

Coverage that typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured.

Q46: A joint that allows only rotational movements

Q67: Which muscle moves the bolus into the

Q100: The knee extensor muscles are all innervated

Q103: The greater trochanter is the insertion point

Q110: Label D: _

Q116: A muscle that makes of the lateral

Q119: All of the motor units of the

Q126: When looking at a cross-sectional image the

Q156: Label B: _

Q165: Someone referred to as having "a strong