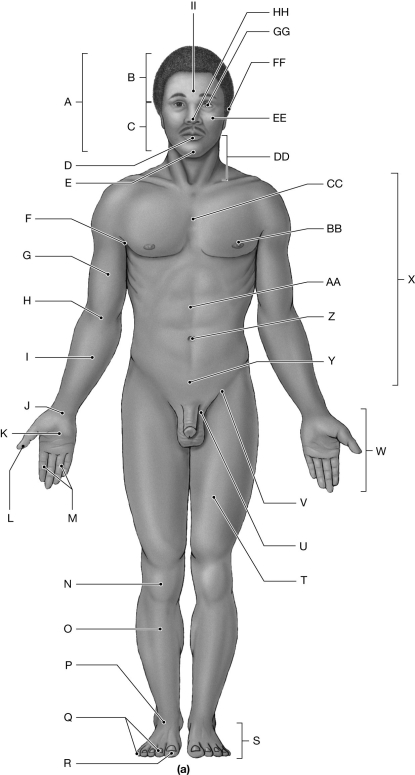

Figure 1.2

Using the figure above, identify the labeled part.

-Label P: ______________________________

Definitions:

Deferred Income Tax Asset

A balance sheet item that represents taxes paid or carried forward but not yet realized on the income statement.

Net Operating Loss

The deficit that occurs when a business's expenses exceed its revenues, excluding taxes and certain other expenses, over a fiscal period.

Future Profitability

An estimation or outlook on the capacity of a business to generate earnings in future periods, often considered for investments or strategy planning.

Deferred Tax Asset

A tax amount that is paid or carried forward, representing future tax savings due to overpayment or advance payment of taxes, or due to allowable temporary differences.

Q37: Label T: _

Q49: Label YY: _

Q76: Label L: _

Q83: Action potentials result from<br>A)closing of ion channels.<br>B)abrupt

Q93: Which of the following neuroglia produce cerebrospinal

Q108: The contraction of the biceps brachii and

Q120: Label A: _

Q196: Label N: _

Q199: Posterior upper limb muscles are innervated by

Q316: The outermost layer of the meninges is