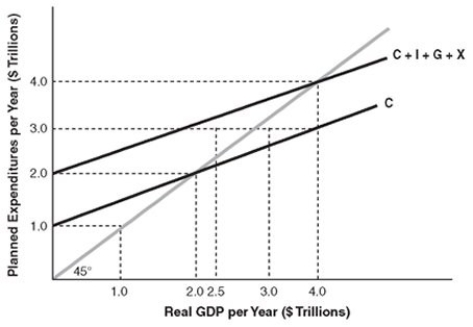

-In the above figure, if real GDP is $1 trillion, there is

Definitions:

Producer Surplus

The difference between the amount producers are willing to sell a good for and the actual market price they receive, reflecting the benefit to producers from selling at a higher price.

Tax

A fundamental fiscal obligation or alternative sort of levy placed upon a taxpayer by a government power, promoting government funding and assorted investments in public infrastructure.

Consumer Surplus

The difference between the maximum price a consumer is willing to pay for a good or service and the actual price they do pay, reflecting the economic benefit obtained by consumers.

Tax Revenue

Tax revenue represents the income that a government receives from taxing individuals and businesses within its jurisdiction.

Q1: Once either expansionary or contractionary fiscal policy

Q75: If real disposable income increases, the average

Q79: In the above figure, when real disposable

Q82: Which of the following fiscal policy actions

Q103: If the government has no debt initially,

Q138: All of the following will cause an

Q144: Are federal budget deficits related to trade

Q202: In the extreme case of a complete

Q246: The inflation associated with the oil price

Q327: Keynes thought that the key to determining