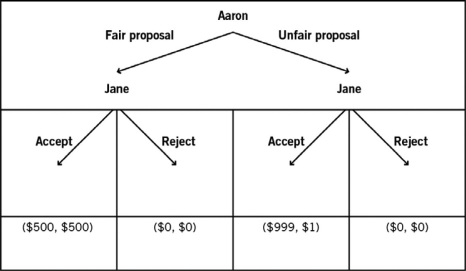

Consider the accompanying decision tree and information to answer the questions that follow.

The decision tree depicts two players (Jane and Aaron) playing an ultimatum game where Aaron is given $1,000 and asked to propose a way of splitting it with Jane. When Jane learns Aaron's proposal, Jane chooses whether to accept or reject the split. If Jane accepts the split, both players receive the money according to Aaron's split proposal. If Jane rejects the split, both players receive nothing. This game will be played only once, so Aaron does not have to worry about reciprocity when making his choice.

There are four sets of payoffs at the terminal nodes of the decision tree. In each node, the dollar amount to the left of the comma represents Aaron's payoff, and the dollar amount to the right of the comma represents Jane's payoff.

-If Aaron were to offer an unfair proposal,experimental results show that Jane would likely punish him by making herself:

Definitions:

Navigation Pane

A user interface component that provides quick access to various sections or functionalities within software applications, often displayed as a sidebar.

Selecting Objects

The action or process of choosing one or more objects in a software application or graphical user interface.

Screen Reader

A software application that converts text displayed on a computer screen into audible speech or Braille, assisting users who are visually impaired.

Alt Text

Alternative text that provides a textual description of an image or object in web pages, aiding accessibility for visually impaired users.

Q25: The market value of cell phones is:<br>A)

Q34: Licensing:<br>A) is a natural barrier.<br>B) creates more

Q44: The accompanying payoff matrix depicts the possible

Q45: The government has decided to give governmental

Q65: The government has identified a situation where

Q69: If the market price is $15 and

Q76: Which of the following lists the three

Q99: When a competitive market becomes controlled by

Q109: The accompanying figure describes the market for

Q117: What will happen in a market where