Use the following information to answer the next fifteen questions.

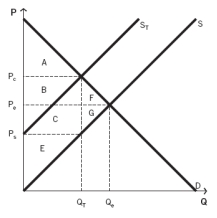

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the amount of producer surplus lost due to the tax?

Definitions:

Income

Refers to the money received, especially on a regular basis, for work or through investments.

Normal Goods

Goods for which demand increases as consumer income rises, and falls when consumer income decreases, opposite to inferior goods.

Inferior Goods

Goods whose demand decreases as the income of consumers increases, in contrast to normal goods.

Income

Income generated regularly from employment or investments.

Q13: Why do economists use models?<br>A) Models are

Q16: You are considering the "dress well,test well"

Q46: When supply shifts right and demand shifts

Q49: If the price of industrial plastic injection

Q49: Which of the following individuals would NOT

Q61: Zero unemployment:<br>A) is only possible in recessions.<br>B)

Q63: If the local government tells gas stations

Q111: The percent change in the overall level

Q111: If the price of a good increases,holding

Q115: The main statistic that is used to