Use the following information to answer the next fifteen questions.

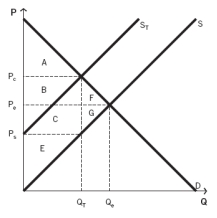

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the revenue collected from this tax?

Definitions:

Labor-Force Participation

The proportion of individuals within the working-age range who are currently employed or are seeking employment actively.

Prime Working Age

The age range typically considered most productive for work, often defined as between 25 and 54 years old.

Labor-Force Participation

The proportion of individuals within the working-age group who are either in employment or seeking employment actively.

Prime Working Age

Typically refers to the age group of individuals considered to be in their most productive years, often defined as ages 25 to 54 in economic studies.

Q7: Individuals who are not working but are

Q15: What was the real GDP in 2013?<br>A)

Q20: Based on the figure,and if we define

Q28: In 2009,the federal government created a program

Q36: All taxes create some deadweight loss,unless:<br>A) the

Q40: What would be the equilibrium quantity in

Q84: Draw a production possibilities frontier (PPF) that

Q124: Which statement best describes absolute advantage?<br>A) DiNozzo

Q130: The textbook shows that the inflation-adjusted movie

Q142: Producer surplus is the difference between:<br>A) supply