Use the following information to answer the next fifteen questions.

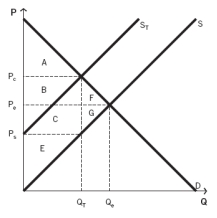

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What areas represent the total tax revenue created as a result of the tax?

Definitions:

Interest Rate Risk

The potential for investment losses due to fluctuations in interest rates.

Zero Coupon Treasury Bond

A government bond that does not pay interest throughout its life and is sold at a discount from the face value.

Reinvestment Rate Risk

The risk that the returns from reinvesting cash flows will be lower than expected due to changes in interest rate.

Market Interest Rate

The prevailing rate of interest available in the marketplace for securities of similar risk and maturity.

Q6: When demand is perfectly inelastic,the demand curve

Q15: Draw a production possibilities frontier (PPF) for

Q24: When the price of ground beef increases

Q41: The value of the consumer price index

Q64: Explain the relationship between the unemployment rate

Q96: Which party is responsible for paying this

Q99: The Bureau of Labor Statistics releases consumer

Q111: What is the total amount of producer

Q117: You are offered two jobs,one in Chicago

Q127: The Internet has enabled workers and companies