Use the following information to answer the next fifteen questions.

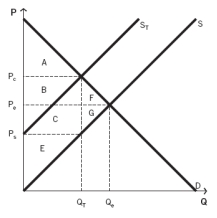

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-When a tax is imposed on some good,what tends to happen to consumer prices and producer prices?

Definitions:

Placenta

A critical organ that grows in the uterus throughout pregnancy, it ensures the fetus receives vital nutrients and oxygen, simultaneously expelling waste.

Secondhand Cigarette Smoke

Exposure to smoke from burning tobacco products used by others, can lead to health issues in non-smokers.

Fetal Development

Refers to the stages of growth and development of a fetus from the embryonic stage until birth, encompassing various physiological and anatomical changes.

Last Trimester

Refers to the final third of a pregnancy, typically encompassing weeks 27 through 40, when significant fetal growth and organ maturation occur.

Q16: Underemployed workers are:<br>A) individuals who are not

Q23: Between 1979 and 2012,service industries employment in

Q28: The accompanying figure describes the market for

Q30: The investment spending category of GDP does

Q57: Ceteris paribus means:<br>A) in sets of two.<br>B)

Q80: In terms of inflation,the period from the

Q83: Economic growth in developed countries has been

Q103: Taxing goods with very inelastic supply generates

Q122: Producers will lose no producer surplus due

Q132: Suppose you live in a community with