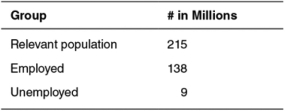

Use the following table to answer the questions that follow.

-According to the table,the labor-force participation rate is:

Definitions:

Net Advantage to Leasing

The potential financial benefits gained from leasing an asset, compared to purchasing it outright, considering taxes, maintenance, and other factors.

Pre-Tax Cost

The cost or expense incurred by a business before the deduction of taxes.

CCA Class

It stands for Capital Cost Allowance Class, a categorization in tax systems for different types of depreciable properties to determine the depreciation rate for tax purposes.

Net Advantage to Leasing

A calculation used to assess the financial benefits of leasing equipment versus purchasing it outright.

Q20: In 2000,annual real per capita gross domestic

Q36: At what price level does the apartment

Q71: Company X sells paper to company Y

Q83: What is the equilibrium quantity in the

Q96: Higher rates of economic growth are negatively

Q97: In 2012,the Target Corporation had $14.4 billion

Q99: Assume that a $0.10/pound tax on apples

Q104: A member of the labor force is

Q107: In a market where supply and demand

Q110: The state of Florida spends $3 million