THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

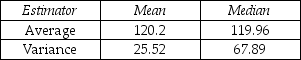

A Monte Carlo study involves 10,000 random samples of size 20 from a normal population with mean μ = 120 and standard deviation σ = 20.For each sample,the mean and the median are calculated,with the following results:

-What does the study suggest about the bias of the estimators in this situation?

Definitions:

Sinking Fund

A fund established by an entity by setting aside revenue over time for the purpose of paying off debt or replacing a future expense.

Protective Covenants

Clauses in a contract or bond indenture that restrict the borrower from certain activities, aiming to protect creditors.

Real Rates

Interest rates or rates of return that have been adjusted for inflation, showing the real purchasing power of the amount.

Nominal Rates

Interest rates or rates of return on investment that have not been adjusted for inflation, representing the face value of financial instruments.

Q6: In a simple regression problem,the following data

Q14: The term used by fund managers to

Q44: If all possible samples of size n

Q60: When testing for the difference between two

Q68: If a sample of size 41 is

Q81: How is hypothesis testing used in problems

Q112: The central limit theorem can be applied

Q145: Suppose that the true proportion of customers

Q188: What is P(Z > 1.2)?<br>A)0.1112<br>B)0.8849<br>C)0.1151<br>D)0.6112<br>

Q227: Given the random variables X and Y