THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

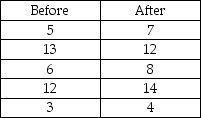

A confidence interval for the difference between the means of two normally distributed populations based on the following dependent samples is desired:

-What is the width of the interval?

Definitions:

Revenues

The total amount of money received by the company for goods sold or services provided during a certain time period.

Net Income

The amount of profit remaining after all expenses, taxes, and costs have been subtracted from total revenue.

Cash Increase

Refers to the rise in cash and cash-equivalent assets within a business or organization.

Cash Decrease

A reduction in the amount of cash a company has on hand, which can result from expenses, purchases, or withdrawals.

Q30: Interval estimates for the variance of a

Q33: A fitness club claims that the average

Q41: An interval estimate is an interval that

Q46: In order to estimate with 95% confidence

Q48: When computing the confidence interval for the

Q59: When testing for the difference between the

Q62: Find the value k such that P(Z

Q121: What is the test statistic for this

Q184: The probability is 0.99 that a randomly-selected

Q228: Normal probability plots provide a way to