THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

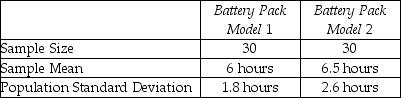

A computer information systems manager was in charge of purchasing new battery packs for laptop computers.The choices were narrowed to two available models.Since the two models cost about the same,the manager was interested in determining whether there was a difference in the average time the battery packs would function before needing to be recharged.Based on two independent random samples,the following summary information was computed:

-Find a 99% confidence interval for the difference in average functioning time before recharging the two models.

Definitions:

Systematic Risk

A hazard inherent to the entire market or a market segment, which diversification cannot diminish.

Unsystematic Risk

Refers to the risk that is specific to a company or industry, and can be mitigated through diversification.

Portfolio Beta

A measure of the sensitivity of a portfolio's returns to the returns of the overall market, indicating the level of market risk associated with the portfolio.

Portfolio Standard Deviation

A measure of the dispersion of returns from a portfolio, indicating the risk involved in holding the portfolio.

Q1: A sample of 50 students is taken

Q1: Find a 95% confidence interval for the

Q35: Which of the following is true of

Q38: A point estimator <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2968/.jpg" alt="A point

Q46: Test at the 5% level,the null hypothesis

Q51: Compute the error sum of squares,SSE.

Q80: The central limit theorem states that if

Q96: Why does the sample size play such

Q98: What is the cutoff point for an

Q228: Normal probability plots provide a way to